How to make money transfers?

How can we help?

-

Become a client

Chevron Down Icon

- What kind of devices can I use to register and become a customer of UniCredit Bulbank?

- Is there a fee for using the Bulbank Mobile App?

- What is Evrotrust?

- How to sign the documents?

- What personal information do I need to provide and why?

- How will I receive my card?

- When can I start using my account?

- When can I start using the Bulbank Mobile App?

- Activate Chevron Down Icon

- Login Chevron Down Icon

-

M-token

Chevron Down Icon

- What is M-token?

- How can I activate M-token?

- What is a One-time password and how to use it?

- What is a code for signature and how to use it?

- How to change my M-token PIN?

- Can I activate and use M-token on more than one device?

- Do I need to have Internet on my phone in order to use M-token?

- What should I do if I want to use M-token on another mobile device?

- What should I do if I lose my mobile phone?

- 3D Password

- Home Screen Chevron Down Icon

- Accounts Chevron Down Icon

-

Cards

Chevron Down Icon

- What information can I get about my cards?

- What is a digital debit card and how I can use it?

- What is dynamic password and how to turn it on?

- When and how can I lock/unlock my bank card?

- What is a digital wallet, how to add a card to it and how to use it?

- How can I defer directly in Bulbank Mobile my payments for purchases made by UniCredit Shopping Card?

- How can I increase my credit card limit?

- How can I request via Bulbank Mobile delivery of my reissued debit card?

- Loans Chevron Down Icon

- Savings and investments Chevron Down Icon

- Payments Chevron Down Icon

- Analyses Chevron Down Icon

-

Products

Chevron Down Icon

- What do I get with an everyday banking plan?

- How to request a new Digital debit card?

- How to request a new debit card?

- How to request a Shopping card?

- How can I increase my credit card limit?

- How to request a consumer loan?

- How to request a new investment plan?

- Where can I see the requests I have sent?

- How to generate a bank a bank account notice for account/s?

- How to request a term deposit through Bulbank Mobile?

- How to request a car leasing?

- My Car Chevron Down Icon

-

Choose category

Chevron Down Icon

- Become a client

- What kind of devices can I use to register and become a customer of UniCredit Bulbank?

- Is there a fee for using the Bulbank Mobile App?

- What is Evrotrust?

- How to sign the documents?

- What personal information do I need to provide and why?

- How will I receive my card?

- When can I start using my account?

- When can I start using the Bulbank Mobile App?

- Activate

- How to activate Bulbank Mobile if I never used the app before?

- Can I log in with Touch ID/Face ID?

- My device is rooted or jailbroken. What does that mean?

- Login

- I have forgotten my PIN code. What should I do?

- I have entered a wrong password a few times. What should I do?

- M-token

- What is M-token?

- How can I activate M-token?

- What is a One-time password and how to use it?

- What is a code for signature and how to use it?

- How to change my M-token PIN?

- Can I activate and use M-token on more than one device?

- Do I need to have Internet on my phone in order to use M-token?

- What should I do if I want to use M-token on another mobile device?

- What should I do if I lose my mobile phone?

- 3D Password

- Home Screen

- What information do I see on the home screen?

- Accounts

- What information can I get about my accounts?

- How to make a default account for payments?

- Cards

- What information can I get about my cards?

- What is a digital debit card and how I can use it?

- What is dynamic password and how to turn it on?

- When and how can I lock/unlock my bank card?

- What is a digital wallet, how to add a card to it and how to use it?

- How can I defer directly in Bulbank Mobile my payments for purchases made by UniCredit Shopping Card?

- How can I increase my credit card limit?

- How can I request via Bulbank Mobile delivery of my reissued debit card?

- Loans

- What information can I get about my loans?

- Savings and investments

- What information do I see on the investment plans screen?

- Payments

- What type of payments can I perform?

- How to make money transfers?

- How to use the „Repeat payment“ and „Return payment“ options?

- How to create, execute, edit/delete a template?

- How to pay my utility bills?

- How to check the outgoing payments?

- How do I check and pay municipality taxes and fees?

- Analyses

- Cost analyses

- Products

- What do I get with an everyday banking plan?

- How to request a new Digital debit card?

- How to request a new debit card?

- How to request a Shopping card?

- How can I increase my credit card limit?

- How to request a consumer loan?

- How to request a new investment plan?

- Where can I see the requests I have sent?

- How to generate a bank a bank account notice for account/s?

- How to request a term deposit through Bulbank Mobile?

- How to request a car leasing?

- My Car

- What's "My car" in Bulbank Mobile?

- How to purchase a Vignette via My Car in Bulbank Mobile?

How to make money transfers?

Transfer between personal accounts

To make a transfer of funds between your personal accounts in UniCredit Bulbank, follow the steps:

- Click on the “Payments” button in the navigation bar at the bottom part of the screen.

- Select the option “Transfer between my accounts”.

- From the drop-down menu, select your personal account that you wish to order funds from, and from the second drop-down menu – your other account onto which to receive the amount.

- In section “Details of the transfer” you need to enter the relevant amount, payment reason, date of payment (the current date is set by default) and then click on “Next”.

- Perform a final review of the accurateness of the entered information and go one step back if you need to make corrections.

- To complete the transfer, press “Pay”, but before that you have the option to save the transaction as a template to be used for future payments.

Payment to a new beneficiary

In order to make an interbank or intrabank transfer to another private Individual or legal entity:

- Press the “Payments” button in the navigation bar at the bottom part of the screen.

- Select “Transfer” and then the option “To a new beneficiary”.

- From the drop-down menu, select your personal account from which to order funds.

- Enter the IBAN of the beneficiary’s account and his/her name.

- In section “Details of the transfer” you need to enter the relevant amount, payment reason, date of payment (the current date is set by default) and then click on “Next”.

- Perform a final review of the accurateness of the entered information and go one step back if you need to make corrections.

- To complete the transfer, press “Pay”, but before that you have the option to save the transaction as a template to be used for future payments.

Interbank transfer in EUR

In order to make an interbank transfer in EUR, to another private Individual or legal entity:

- Press the “Payments” menu in the navigation bar at the bottom part of the screen.

- Select “Make a payment” and then the option “Interbank transfer in EUR”.

- From the drop-down list, select your personal account from which to order funds.

- Enter the IBAN of the beneficiary’s account and his/her name.

- From the drop-down list, select the beneficiary’s country.

- In section “Details of the transfer” you need to enter the relevant amount, payment reason, date of payment (the current date is set by default) and then click on “Next”.

- Perform a final review of the accurateness of the entered information and go one step back if you need to make corrections.

- To complete the transfer, press “Pay”, but before that you have the option to save the transaction as a template to be used for future payments.

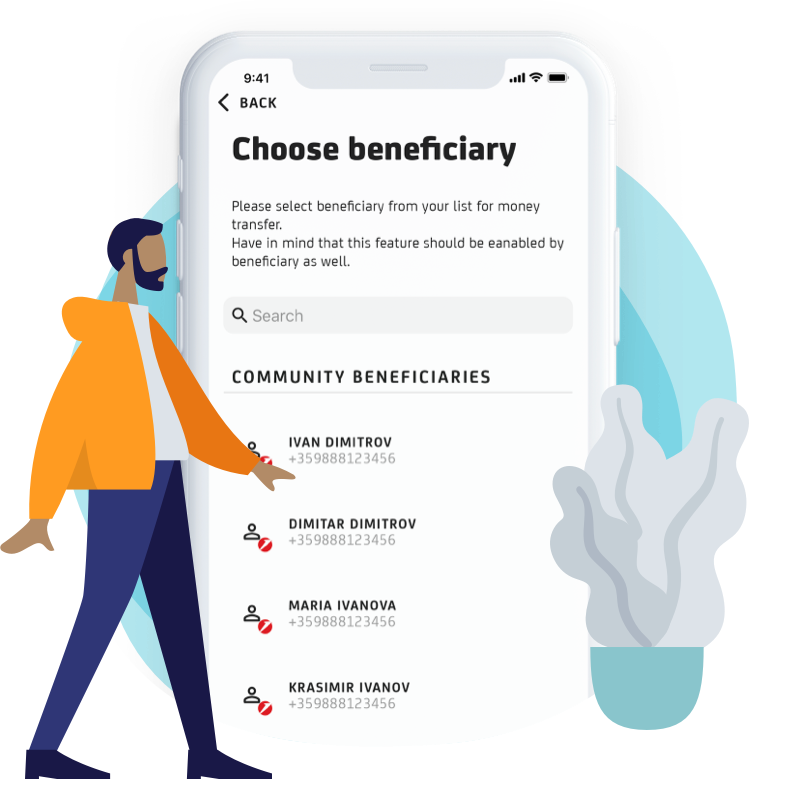

Payment via mobile number

In order to activation:

- Press the Payments menu in the navigation bar at the bottom of the screen.

- Select "Make a payment" and then the option "To a phone number".

- Click the "Activate / Deactivate" toggle button to activate the functionality.

- Confirm the terms and conditions of the functionality.

- Accept all the above listed terms and continue with "Forward".

- Confirm your mobile number.

- Choose Account to Receive from the drop-down menu.

- Click the "Activate" button.

In order to make а Payment via mobile number:

- Press the Payments menu in the navigation bar at the bottom of the screen.

- Select "Make a payment" and then the option To a phone number.

- From the drop-down menu, select the account from which you want to deposit funds, and from the second - the mobile number from your phonebook.

- Аllow access of Bulbank Mobile to the phone contact list of your device in order to make payments to mobile number.

- In the "Payment details" section, enter the desired amount, reason for the transfer and click "Next".

- Preform a final review of the accurarateness of the entered information and go one step back if you need to make corrections.

- To complete the transfer, press "Pay".

Payment to the state budget

To make a payment to the budget (taxes, fees, fines, insurance, etc.):

-

Tap the Payments button on the navigation bar at the bottom of the screen.

- Select "Transfer", then the "To budget" option.

- From the drop-down menu, select your personal account from which you want to deposit funds.

- Enter the IBAN of the recipient's account and its name.

- In the "Transfer details" section, enter: amount and grounds for the transfer; date of execution of the payment (by default the current date is indicated); information of the obligated person; number, date and period of the document on which you make payment. Click the "Next" button.

- Take a final look of the information entered and go back if there are any inaccuracies.

- To make the transfer, click "Pay", before which you can save a sample template to use for future payments.

Install Bulbank Mobile in your phone

Bank quickly and simply, whenever and wherever you want with a few clicks!