UniCredit Shopping Card

How it works?

You can easily and conveniently use your UniCredit Shopping Card for installment purchases in merchant outlets as well as online with equal monthly installments.

When you choose to make a deferred payment in 3 installments in Bulbank Mobile, you pay 0% fee.

Example: You have 1,000 BGN credit limit on your UniCredit Shopping Card and you make 3 purchases in the month in which you make a deferral of payments for different periods.

When making a payment of the total amount due of all monthly installments of your deferred purchases, no interest will be charged on them.

*When making a purchase for BGN 120, with a deferral in 3 installments in Bulbank Mobile with 0% fee for a deferral of payment, the monthly installment is BGN 40 out of the total payable amount of BGN 120 and AIR is 0%; APR is 0% on the condition that the purchase shall be repaid in 3 installments, as agreed.

**Purchase 2: When making a purchase for BGN 240, with a deferral in 6 installments in Bulbank Mobile with 6% fee for a deferral of payment, the monthly installment is BGN 42.40 out of the total payable amount of BGN 254.40 and AIR is 0%; APR is 23.42% on the condition that the purchase shall be repaid in 6 installments, as agreed.

***Purchase 3: When making a purchase for BGN 360, with a deferral in 12 installments in Bulbank Mobile with 12% fee for a deferral of payment, the monthly installment is BGN 33.60 out of the total payable amount of BGN 403.20 and AIR is 0%; APR is 28.46% on the condition that the purchase shall be repaid in 12 installments, as agreed.

your UniCredit Shopping Card now!

Features

Credit limit

Iconfrom BGN 500 to BGN 4 999

Currency

IconBGN

Time limit for issuing

IconStandard - within 5 working days

Interest rate

Icon1.49% for payments at merchant outlets, on the Internet or cash withdrawals at ATMs

Annual expense ratio

IconExample: 19.44% with a repayment term of 12 months, utilized loan limit of BGN 1,000, monthly installment - 3% of the amount of the utilized limit and a monthly interest rate of 1.49%

Card validity

Icon4 years

Annual fee

IconPromotional BGN 0 for the first year, after this period - reduced to BGN 25

Deferral of payment

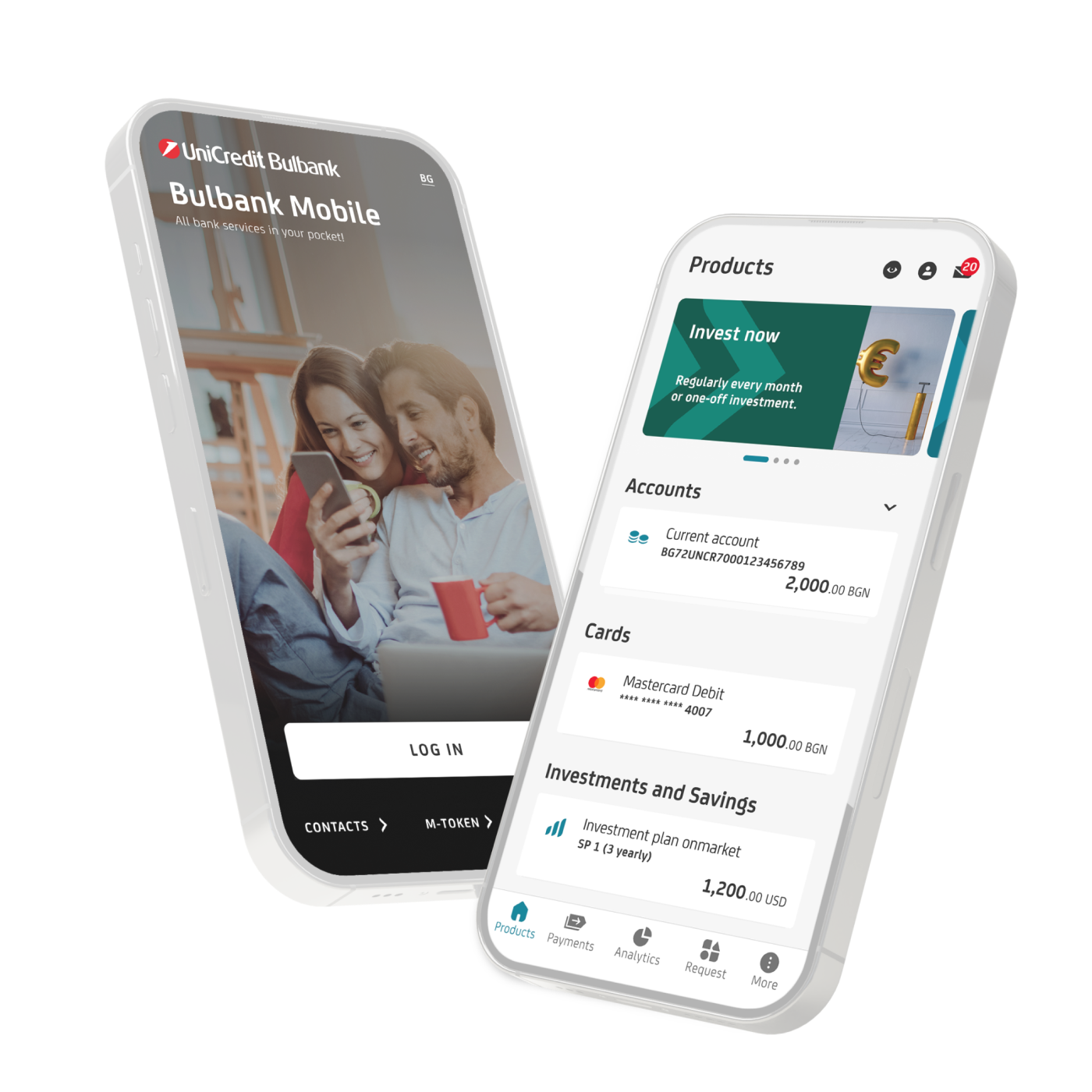

Iconin Bulbank Mobile or Bulbank Online only in the month in which the payment was booked

Minimum repayment amount

Icon3% of the authorized credit limit or total current due amount

Grace period

Iconup to 45 days for purchases at a POS terminal device

Due date

IconBetween the 1st and the 15th day of the month

Lock/ Unlock a card

IconYou manage the status of your card for free on your own via Bulbank Mobile

24/7 Call center

IconIn case you have any questions or experienced an incident related to your card - 0700 184 84

The credit limit is provided by UNICREDIT CONSUMER FINANCE EAD, a subsidiary of UniCredit Bulbank AD.

How can I make a deferral of payment and for what period of time?

Via Bulbank Mobile or Bulbank Online can be deferred every purchase made on real or virtual POS terminal in Bulgaria and abroad, only in the month in which it was booked. When making a deferral of payment for a purchase for 3 months the fee is 0%, and nd for any other period, a fee for deferral will be charged in accordance with the Tariff of the Bank for individuals, which is calculated as a percentage from the purchase price, depending on the chosen number of installments. The fee will be withheld from the limit together with the purchase price and will be paid in equal parts together with each monthly installment.

What is the term for deferral?

A particular purchase can be deferred in installments after its registration in Bulbank Mobile or Bulbank Online within the same accounting period.

Can I defer payment of a purchase if it was made at a POS terminal device of another bank?

Yes, via Bulbank Online or Bulbank Mobile.

What are the possible periods for payment deferral?

When you defer a payment, you can select one of the following periods: 3, 6, 9, 10, 12, 18, 24, 36 months.

Is it possible to defer any payment?

You can defer payments made with UniCredit Shopping card exceeding BGN 100.

The transactions that cannot be deferred are:

- Cash withdrawal at an ATM

- Cash back

- Betting transactions

- Transactions at a POS terminal device at a casino

How can I activate the card?

1. When receiving the card in a branch of the bank:

Insert the card in the ATM of the Bank and select from the menu “Other Services” and then “Manage PIN” and “Change PIN”. Enter the PIN, provided in the envelope, and then twice enter the new PIN; after selecting “Confirm”, your card will be active.

2. When getting your card delivered to your specified address:

Log in to Bulbank Mobile, find the inactive card and select the option “Card Activation”. Enter the verification code from the enclosed letter and the PIN will be visualized on the screen; your card is now active.

Upon performing a bank card transaction on a real or virtual device abroad in a currency different from the currency of the card account, the transaction amount shall be converted in an amount for sending the financial output of the executed transaction from the Acquiring Bank of the merchant that has accepted the payment to the Card Issuing Bank at the exchange rate of the International Card Organization (ICO), VISA or Mastercard applied on the day of sending. UniCredit Bulbank AD shall book the transaction on the Client’s account where the sent amount debiting the Client’s account shall be converted in an amount in the currency of the account at the respective buy/sell exchange rate of UniCredit Bulbank AD applied on the day of booking the transaction (which may be different from the day of sending the payment). The currency of the amount of the sent payment transaction is USD (for payments made in US dollars) and EUR (for all other payments). UniCredit Bulbank AD does not apply any additional fees in case of revaluation of the bank card transactions.

Application

Contact us

On 0700 11 660

At a bank branch

Request your card at any branch of the bank.

Security Tips

Take care of your financial security by following a few simple rules when using your card.