Debit Card Mastercard

Features and Fees

Debit Mastercard is the international debit card with contactless functionality which ensures guaranteed and secured access to your funds 24 hours a day.

Use the card in the standard manner or make contactless payments in your daily card purchases. Pay quickly and easily in any merchant outlets marked with the contactless payment symbol.

Currency

IconBGN, EUR and USD

Validity of the card

Icon6 years

Time limit for issuing

Icon5 working days for standard orders

Additional card

IconYes, according to the tariff

Lock/Unlock

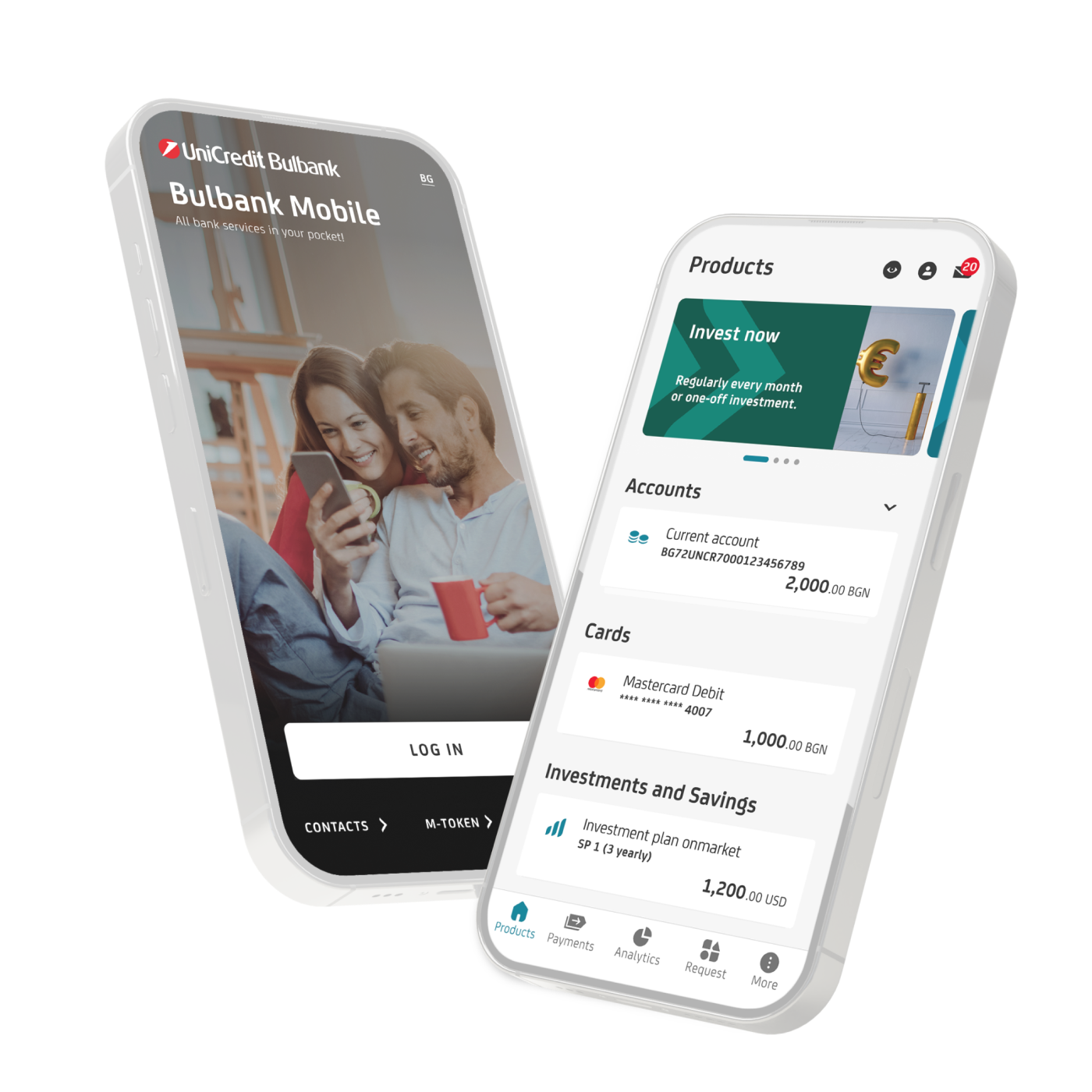

IconYou manage the status of your card free-of-charge via Bulbank Mobile using the blocking and activation functions

Overdraft opportunity

IconYes, up to 5 salaries

24/7 Customer Service Centre

IconIn case of accident or in case of balance inquiry necessity

Secure payments to online merchants

IconWith "Dynamic Password"

Maximum protection

Iconof the card payments at all ATMs and POS terminals

Review the full list of the card parameters determined pursuant to the Tariff and the General terms and conditions for bank cards and for provision services via bank card as an online paument tool.

When making a transaction abroad with a bank card on a real or a virtual POS device in a currency different from the card one, the sum of the transaction is converted to a sum of the settlement in the exchange rate, defined by the International card organisations, applied on the settlement day.

UniCredit Bulbank books the transaction to the customer’s account according to the official FX rate that the bank applies on the transaction accounting (it may be different from the day of the payment sending). The settlement currency is EUR.

UniCredit Bulbank doesn’t apply any additional commissions at the currency conversion on the transactions with bank cards.

Card activation

The card activation process is now much faster and easier. Once you have your bank card, you can activate it yourself by changing your original PIN at UniCredit Bulbank’s ATM or all other ATMs with the logo of BORICA AD*.

*Activation of a card and change of PIN code is possible only at ATMs in Bulgaria!

Application of the Card

Debit Mastercard can be used in more than 32 million merchants outlets all over the world, in the Internet and at 1.9 million ATMs which accept Mastercard.

- Cash withdrawals from ATM and POS terminal in any bank branch.

- Contactless payments – quick, easy and secure payment with only one move without a requirement to enter PIN for card purchases up to BGN 100 in merchant outlets in the country marked with the contactless payment symbol.

- Payment of products and services offered in merchant outlets at POS terminal in the country and abroad.

- Payment of various goods and services offered in the Internet.

- Booking and rental services - cars, airline tickets and hotels.

- Payment of monthly bills for electricity, central heating, phone and other services offered in the Internet through the ePay.bg system (the transaction can be executed after a registration at an ATM)

- Payment of bills and services from an ATM in Bulgaria through the B-Pay system.

- PIN change account balance and last five transactions only at ATMs in Bulgaria.

Find out how the contactless payment works

If the terminal is marked with the typical symbol you can use your card to make contactless payments as follows:

-

You see the amount on the display of the POS terminal

-

Place the card close to the POS terminal symbol.

-

The terminal gives an audible and light signal, notifying that the transaction is completed.

In case of contactless payments abroad the payment amount below which PIN is not required is different and is determined by the Bank which services the terminal and by the international card organisations (ICO).

For example, in Europe the average payment limit below which no PIN is required is EUR 50.

How to Apply

Required documents

- Client’s ID card

- Application form for debit card for individuals

Apply for your Debit Mastercard

Online

Fill in the online form and our consultant will contact you.

In branch of the bank

Apply for the card in any bank branch.

Through the online and mobile banking

Security Tips

Take care of your financial security by following a few simple rules when using your card.

Additional Card Services

Other Debit Card Offers