Digital Debit Card

Features and Fees

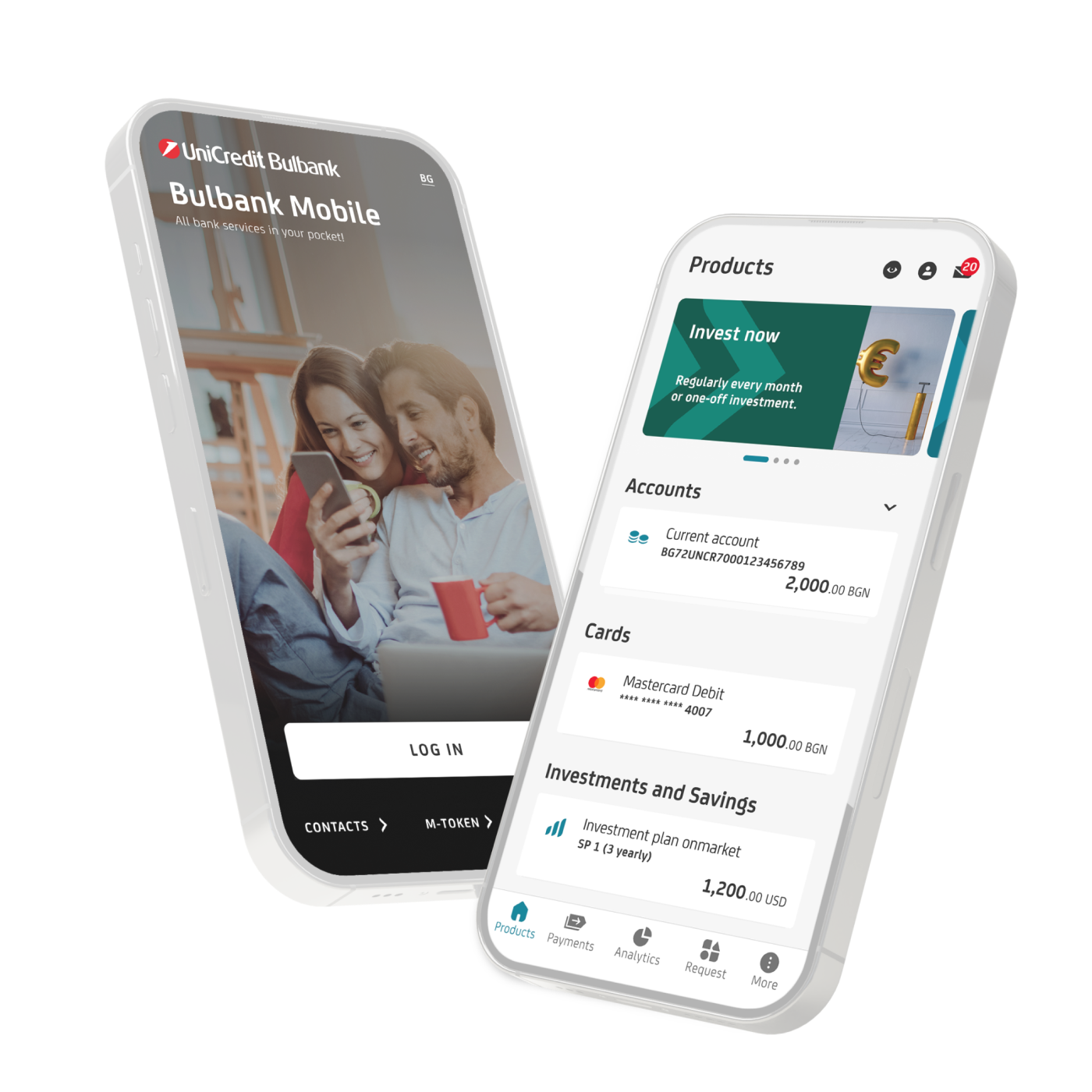

A digital debit card is an international banking card allowing guaranteed and secure access to your funds at any time of the day. The card is issued instantly via Bulbank Mobile and does not exist in material form, helping you protect the environment by reducing the use of plastic and limiting the emissions resulting from the production, packaging, and transportation of the physical cards.

Save time and enjoy convenience with our Digital debit card - no need to wait for a material card and its activation. Once the request is successfully completed, the card will be issued and will appear instantly in the mobile banking app - ready to use, with no further action required on your part.

Issuing

IconThe issuance of the Digital card is without fees and can be requested to a new or existing account*

Card digitization

IconAdd card to Apple Pay, Google Pay and Digital Wallet for Huawei

Currency

IconBGN

Validity of the card

Icon6 years

Lock/Unlock

IconIn Bulbank Mobile you can lock/unlock your digital debit card.

Payment of goods and services in the Internet

IconNo-fee payment of goods and services at POS or online

Maximum protection

IconAutomatic card subscription for 3D Dynamic Password and free notifications in Bulbank Mobile

Мaintenance

IconNo monthly service fee for a newly opened digital payment account, if there is another active account in the "Plus", "Max" and "Private" plan**

via Bulbank Mobile

IconThe issuance of the Digital card is immediate through the mobile application

Application

IconUse the card wherever contactless payments are accepted, when shopping online, withdrawing and depositing money from contactless UniCredit Bulbank ATMs

*An existing account can only be used if you have an active account in one of the Daily Banking ‘Plus’, ‘Max’ or ‘Private’ plans. Customers on the ‘Start’ plan may also request a digital debit card, but only under a new account.

**The request on an existing account is only possible if you have an active account in one of the "Plus", "Max" or "Private" daily banking plans. Start plan customers could issue a digital debit card, but only to a new account.

Frequently Asked Questions

For added convenience, you will receive a notification in Bulbank Mobile when the card has been successfully issued and is ready to use.

All existing UniCredit Bulbank customers with an activated Bulbank Mobile banking app may benefit from the digital debit card offer. If you are not a bank customer, you can open a debit card account remotely, in just a few clicks.

To use your digital debit card at a real POS terminal, you need to add it to Apple Pay, Google Pay or Digital Wallet for Huawei devices not supporting Google Services, according to the respective operating system. Once added, you can use the card wherever contactless payments are accepted.

You could create a PIN code for your Digital debit card from the “Create PIN code” option located in the “Settings” menu under the card.

You won't owe a fee when you pay with your digital debit card at a contactless POS terminal or online.

You may issue up to six active digital debit cards to one account.

The digital current account is the one that will be opened and to which the digital debit card will be issued if you have selected the option of issuing the card to a new current account.

You may have more than one digital current account, depending on whether you have added an account to a plan. If you have an active account added to a Plus, Max or Private plan, you will be entitled to a certain number of free accounts. If you have an active account in:

- Start Plan - you will not entitled to a digital card on your existing account. You may request a digital debit card under a new account with a monthly fee as per the Bank's Tariff

- Plus Plan - you will be entitled to one free Digital Current Account and an unlimited number of paid ones, according to the UniCredit Bulbank Tariff;

- Max Plan or Private Plan - you will be entitled to up to five free digital current accounts and an unlimited number of paid ones, according to the UniCredit Bulbank Tariff.

The Digital debit card is issued with the option to create a PIN code (chosen by the customer) as well as and to be to Apple Pay, Google Pay or Digital Wallet for Huawei devices.

After successfully creating a PIN code and adding the card to one of the listed wallets, you can withdraw and deposit money at all UniCredit Bulbank contactless ATMs with a deposit capability.

All details regarding your Digital debit card are available in Bulbank Mobile app, under the “Card Details” section, while the option to create a PIN code can be found in “Settings” located below it in the “Cards” menu.

The card will not be deactivated and will remain active, but will require reactivation of Bulbank Mobile to use. In case you wish to deactivate your digital debit card, you will need to visit a UniCredit Bulbank branch to sign a ‘Deactivation Request’.

You don't need to do anything to have your digital debit card renewed. It will be automatically renewed and available in the Bulbank Mobile banking app.

With a one-time qualified electronic signature (QES), you can sign a wide range of documents quickly and securely from your mobile device. Signing is done by receiving a free SMS with a code sent to the phone number specified in the request for issuing a Digital debit card.

Documents signed in this way are fully valid and equivalent to their paper counterparts.

Issuance

If you are a UniCredit Bulbank customer with an active Bulbank Mobile app, you can request a digital debit card by:

-

Logging in to Bulbank Mobile, selecting the ‘Request’ menu and then ‘Digital Card’

-

Selecting whether the card is issued to a new or existing account

-

Reviewing the details of your request and signing the documents

-

Once successfully signed, the card will be automatically subscribed to 3D Dynamic Password and free transaction notifications in Bulbank Mobile