Money Transfers

New

We would like to remind you that from 19.12.2023 the introduction of the new forms for payment transactions started, which replace the existing ones:

- Deposit Slip

- Payment Order for Cash Transfers - New document

- Cash Withdrawal Order

- Payment Order for Credit Transfer

- Direct Debit Consent

- Direct Debit Payment Order

Until 31.12.2024, the Bank continues to accept for execution the old forms of specimen payment documents.

Dear clients,

In the current complicated international environment, taking care of the interests of each client and strictly respecting the applicable legislation with regard to restrictive measures imposed by the UN, the EU and OFAC, remains our priority with due respect and responsibility.

In connection with the execution of cross-border transfers from/to Russia, we would like to inform you that the bank cannot commit to or give a firm confirmation that each transaction will be executed in a timely manner, given the need to perform checks in accordance with the regulations, procedures and sanctioning regimes in force that banking institutions should comply with when executing payment transactions.

Still, even today, we, UniCredit Bulbank AD, remain committed to making additional efforts for the correct application of the restrictive measures, taking into account the legal requirements in each individual case.

Local Money Transfers

UniCredit Bulbank makes interbanking transfers in national and foreign currencies by using real time connection systems between its branches and the head office.

Transfers to and from other banks in BGN are made through BISERA and RINGS national payment systems within 1 hour or 1 day, depending on the selected value date.

International Money Transfers

UniCredit Bulbank transfers in all currencies specified in п. III of the Interest Rate Bulletin for legal entities and sole traders through a wide correspondent network. When making international money transfers we recommend using the bank’s form in order to get a better quality service and greater customer convenience.

The Bank executes international transfers in foreign and local currencies to and from any point in the world as requested by the customer:

- Outgoing transfer within 1 working day (ТОМ value date)

- Outgoing transfer with same day value date (upon consultation with a bank officer)

We provide maximum protection of interests of our customers. Therefore, we provide information about all possible options and help you choose the right one for you in each specific case. In terms of payment of costs of each transfer until it reaches the end recipient, there are three options:

All transfer expenses, including those of the Bank shall be borne by the recipient - where the recipient's account is kept in a bank outside the country of the European Economic Area (EEA), irrespective of the currency of payment.

All transfer related costs are borne by the remitter. In addition, he pays a fixed amount. This guarantees the receipt in full of the amount ordered and no additional costs from other banks involved in the payment chain.

Standard Payments

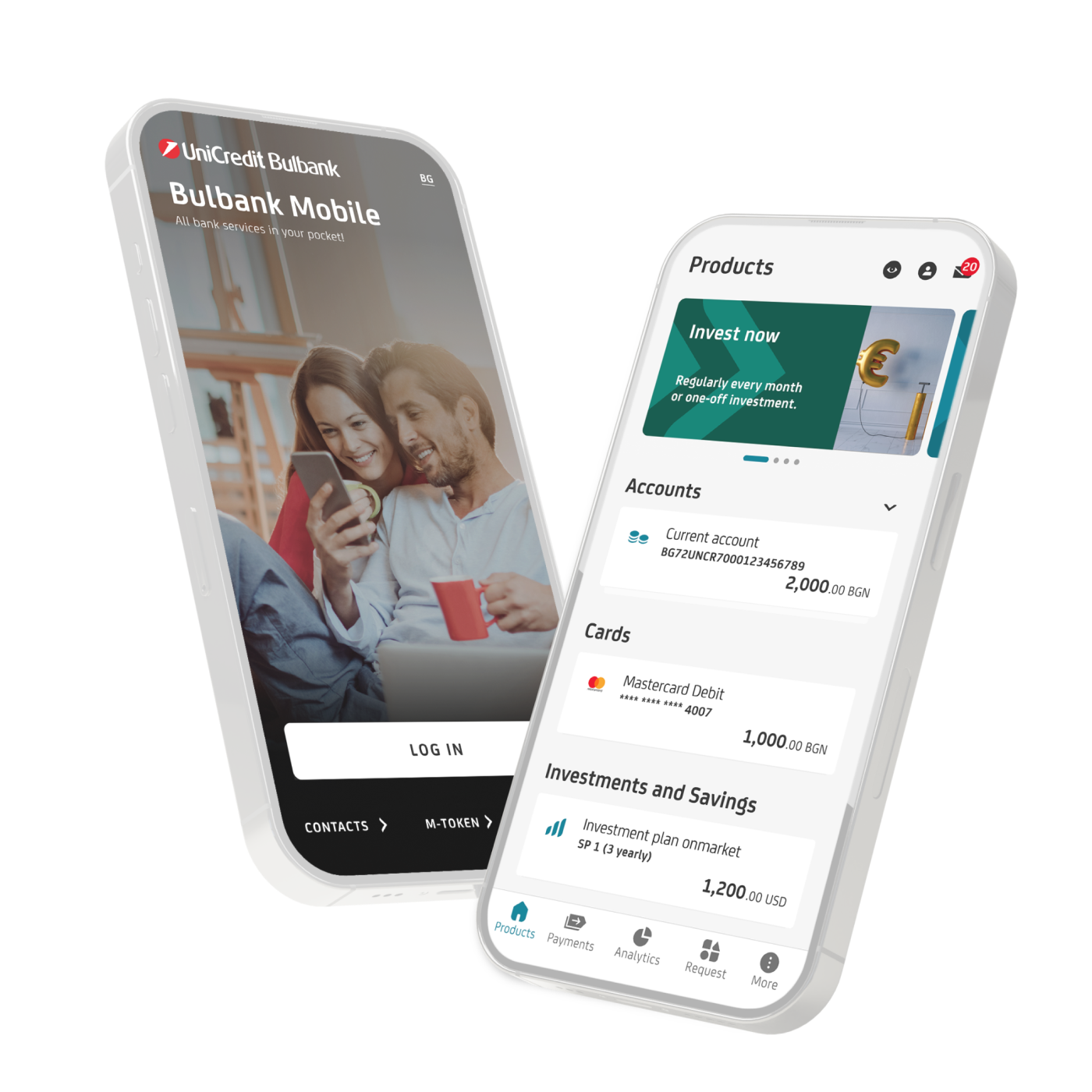

Executed by all branches of the bank. Besides transfers initiated in its branches, through the Bulbank Online system the customers can order transfers electronically.

If you have any additional questions, please visit the closest branch of UniCredit Bulbank or contact us.

All transfers and payments to and from other banks in Bulgaria and abroad are made in strict abidance by all laws and regulations issued by the relevant regulatory authorities.

Documents Required for the Execution of Currency Transfers and Payments

For payment of amounts up to EUR 15 000 or their equivalent in another currency

- Transfer order (form)

For payments in foreign currency exceeding EUR 15 000 or their equivalent in another currency

- Transfer order (form)

- Declaration Attachment to Article 2, para. 1 of Article 2, para. 1 of the Ordinance on the Information and Documents Submitted to Payment Service Providers in Executing Third Party Cross-border Transfers and Payments (form)

- Documents evidencing the grounds for transfer – contracts, invoices, etc. for countries outside the EEA.

- Cross-border credit transfer - 22.02.2021 498.0 KB

- Declaration under art.2, para.1 of the Ordinance 469.9 KB

- Cross-border credit transfer in EUR for the EEA - 22.02.2021 715.6 KB

Note: According to the provisions of the Measures Against Money Laundering Act, persons (customers of the bank) carrying out an operation(s) or transaction(s) in cases where the value of the operation or transaction is equal to or exceeds:

- The BGN equivalent of EUR 15 000 or the equivalent in another currency, regardless of the manner in which the payment is made, and whether the operation or transaction is carried out as a single transaction or several related transactions;

- the BGN equivalent of EUR 5 000 or the equivalent in another currency where the payment is made in cash, regardless if the operation or transaction is carried out as a single transaction or several related transactions;

are obliged to declare the origin of these funds by filling in a declaration (an integral part of the form for ordering a cross-border funds transfer) under Article 66(2) of the MAMLA (as per a template) before carrying out the relevant operation(s) or transaction(s), except in the cases specified by the law.

Related Products