Virtual bank branch

What is a virtual bank branch?

Whether you're applying for a bank loan, looking for your dream home or exploring investment opportunities, you no longer need to visit a branch to get expert service and a personal touch. Say goodbye to signing paperwork and use the time you save for the good times.

What are the advantages?

We present you a comprehensive, efficient, faster and easier way of banking through conveniences such as:

Contact with Personal banker from anywhere in the world

Remote consultation at a time and place convenient for you

Remote request and management of banking products and services

Secure electronic signing of documents

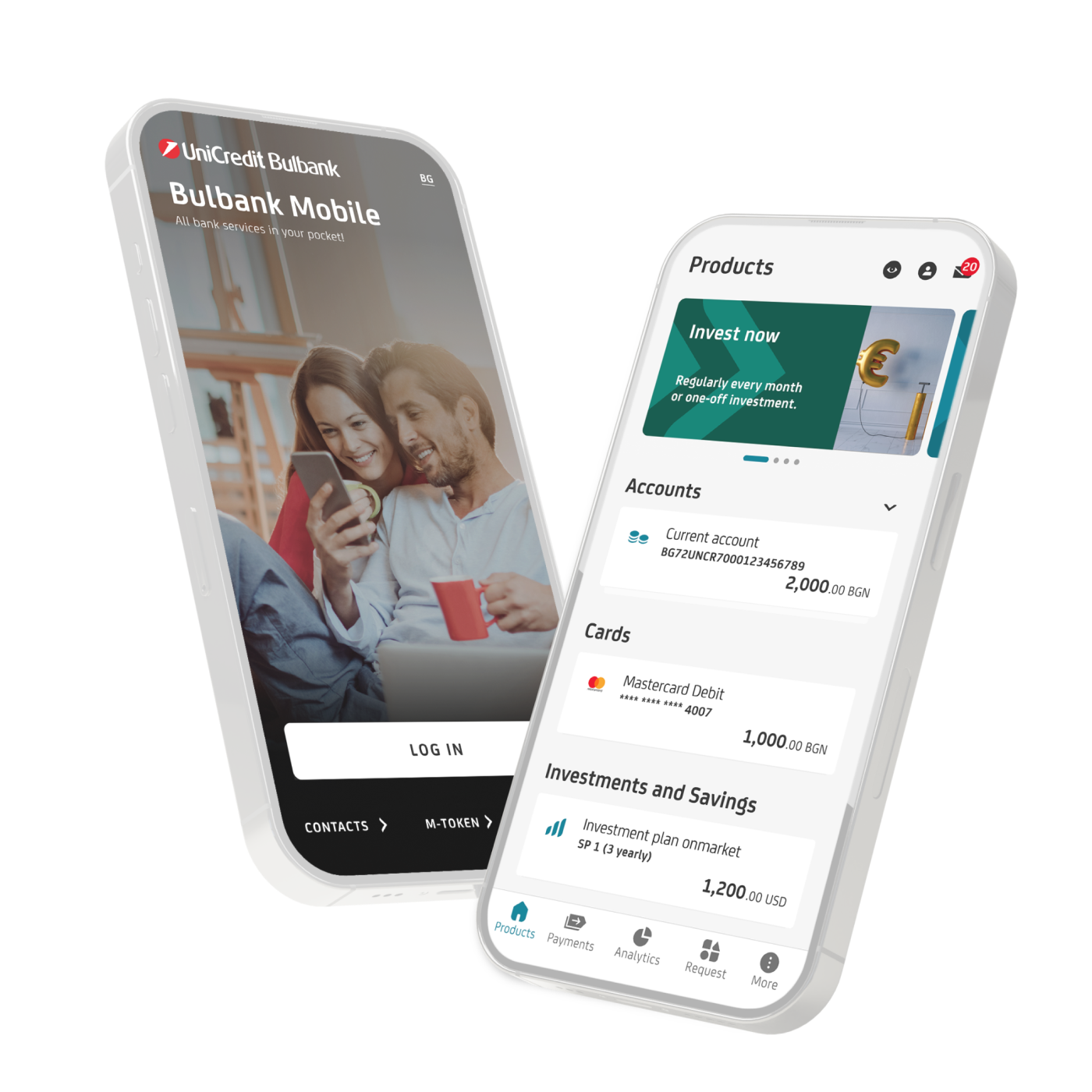

Banking products and services you can use only with phone in hand and save time

For individuals

- Current account with debit card and Plus plan fully online and fee-free for 12 months and innovative digital card

- Consumer credit with no processing fee

- Mortgage loan without visiting a bank branch

- Credit cards with the ability to defer payments in installments of the customer's choice.

- Remote consultation for personal savings and investments

For legal entities

- Business account with debit cards, online banking completely remotely with no fee for 6 months

- Business loan for working capital needs

- Remote credit for your investment plans

- Credit cards for emergency payments

- POS terminals

- Savings and investments for your business needs

Wondering how the service works or need more information?

Request a consultation and our experts will get back to you as soon as possible.

Frequently Asked Questions

To take advantage of the Virtual Affiliate features or if you have additional questions, please fill out the appropriate request form according to whether you are an individual or a legal entity. One of our consultants will contact you to assist you as soon as possible.

We created the virtual bank branch entirely for the convenience of our customers who prefer to bank remotely. By becoming a service user, you can benefit from the full range of the bank's products and services.

In case of need, you can always visit our branch where you will be able to manage the same products and services requested through the virtual branch.

Of course! Anyone can become a customer of the service.

There is no additional charge to take advantage of the service.

If you are a Bulgarian citizen living abroad, this service is right for you. You can now benefit from a personal and professional banking service wherever you are, from anywhere in the world. All you need is a laptop or smart device with an internet connection.

For us, the relationship between personal banker and customer is the most important, so the service in our virtual bank branch is performed by a competent and well-trained team of bank employees. They will advise you and provide you with the best banking products and services according to your needs.

To identify yourself and sign the documents completely online you only need a mobile phone and an ID.

You sign documents remotely with a qualified electronic signature (QES) or via a mobile application developed by Evrotrust Technologies S.A. (Evrotrust) as a provider of qualified authentication services.

How to use Evrotrust:

- Download and install the Evrotrust mobile app.

- Identify yourself remotely: Take a photo of your ID card, take a selfie via your phone.

- Get prepared documents from UniCredit Bulbank in the Evrotrust app

- Sign the documents received from the bank for free with a qualified electronic signature – a personal PIN created in Evrotrust.

View and store all electronically signed documents in the Evrotrust mobile app.

The Virtual Banking Branch has standard business hours and all requests received outside of these hours will be processed the next business day.