Dynamic Invest Insurance

What is a Dynamic Invest Life Insurance linked to an Investment Fund?

An insurance product which combines the security offered by a life insurance with Allianz, having the investment opportunities of Allianz Global Investors and Amundi Asset Management Funds. Investment insurance offers full transparency with regard to the premiums paid by the Client - one part of them is invested in an investment programme preliminary chosen by the Client and the other guarantees an insurance protection. Future Invest Life Insurance is a combination of insurance protection against contingencies and a possibility to secure the future of your child.

Example

Monthly payment

EUR/USD 60 for 15 years Term of the policy

Insurance amount

EUR/USD 1 000

Amount on the personal account

EUR/USD 13,014.19 with expected average annual yield 3%

In case of a fatal accident, the insurance amount will be paid out together with the amount on the personal account.

* For each insurance programme, the client can choose only one investment strategy.

* Any previous performance of the Funds has no bearing on the future results from this activity. The value of the shares of the Funds and their yield can either increase, or decrease. The profit is not guaranteed and there is a risk that investors may not recover the full amount of the invested funds.

Characteristics

Term

Iconfrom 10 to 40 years

Currency

IconEUR or USD

Amount of the payment

Iconfrom EUR 30 for monthly premiums; from EUR 360 for annual; from EUR 1000 for annual premiums

You choose the type of payment

Iconmonthly, annual or one-time payment

Security and protection for you and your family

- The insurance amount of 1000 EUR/USD and the amount on the personal account will be paid.

Medical costs package:

- Temporary disability due to an accident

- Hospital stay due to an accident

- Costs for medicines and consumables in case of an accident

Investment in the international financial markets in Funds of:

- Part of Allianz SE – one of the leading companies in the offering of financial services globally with more than 125 years of history

- The company manages more than 560 billion USD of assets

- Offices in more than 25 countries in the USA, Europe and Asia

- A team of 780 professionals

Funds offered by Allianz:

Allianz Dynamic Multi Asset Strategy 15 – IT – EUR (Conservative strategy in EUR)

Allianz Dynamic Multi Asset Strategy 50 – IT – EUR (Balanced strategy in EUR)

Allianz Dynamic Multi Asset Strategy 75 – IT – EUR (Aggressive strategy in EUR)

- Many years of experience in the offering and management of mutual funds

- The company manages more than 1.527 trillion EUR of assets

- First place in Europe and in the Top 10 globally

- Offices in more than 37 countries and more than 100 million clients worldwide

- A team of 4500 professionals

Funds offered by Amundi:

Amundi Funds Global Multi-Asset Conservative – EUR (AMUNDI Euro Conservative)

Amundi Funds Global Multi-Asset - EUR (AMUNDI Euro Balance)

Amundi Funds Pioneer Global Equity - EUR (AMUNDI Euro Dynamic)

Amundi Funds Pioneer Income Opportunities – USD (AMUNDI Dollar Balance)

Amundi Funds Pioneer U.S. Equity Fundamental Growth – USD (AMUNDI Dollar Dynamic)

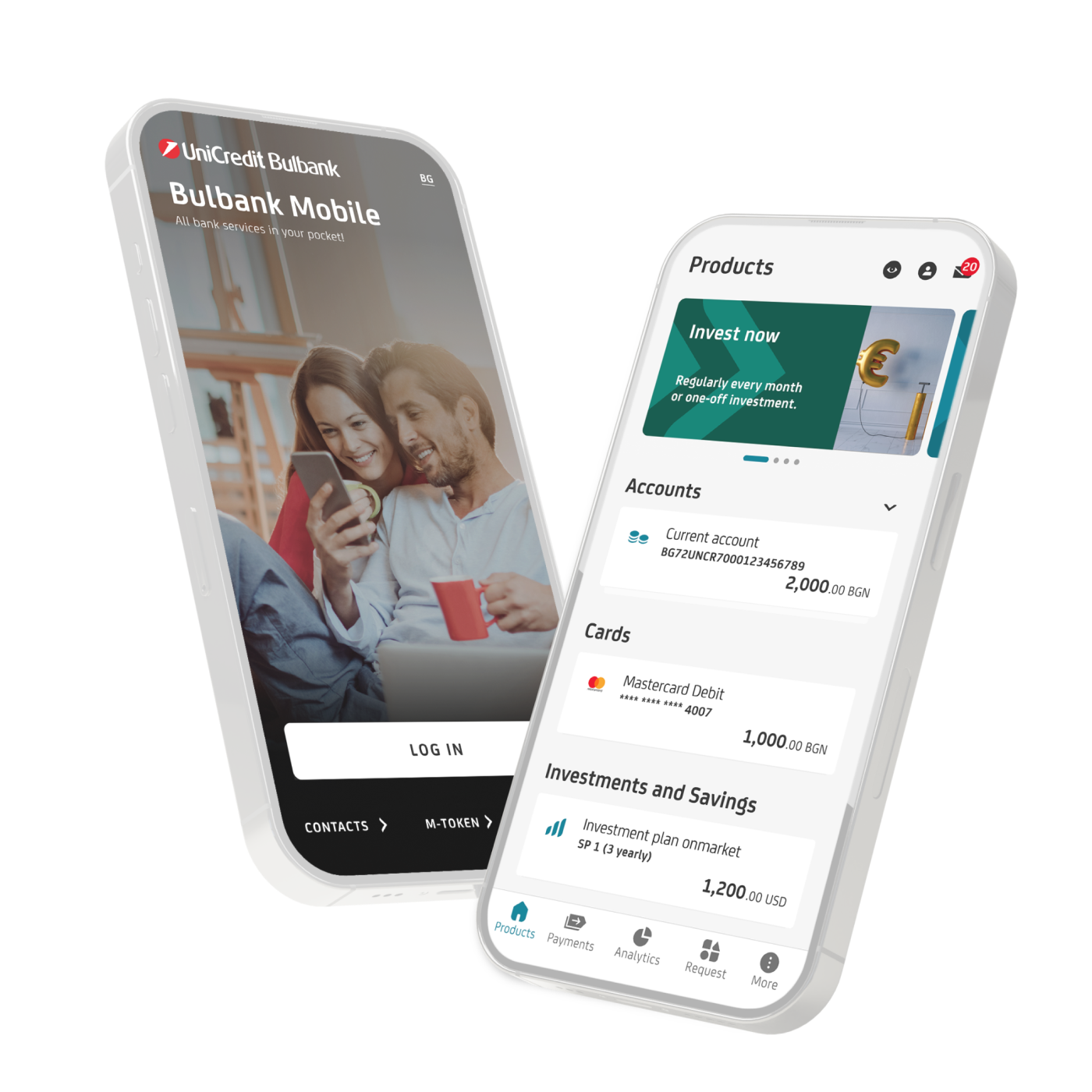

* “UniCredit Bulbank AD carries out investment intermediary services on the grounds of a concluded investment intermediary agreement with ZAD Allianz Bulgaria Life. UniCredit Bulbank AD does not provide advice pursuant to §1, item 55 of the Supplementary Provisions of the Insurance Code concerning the distributed insurance product and it acts on behalf and for the account of the Insurer.