Mortgage loan for a prefabricated house

Looking for a mortgage loan for your prefab house?

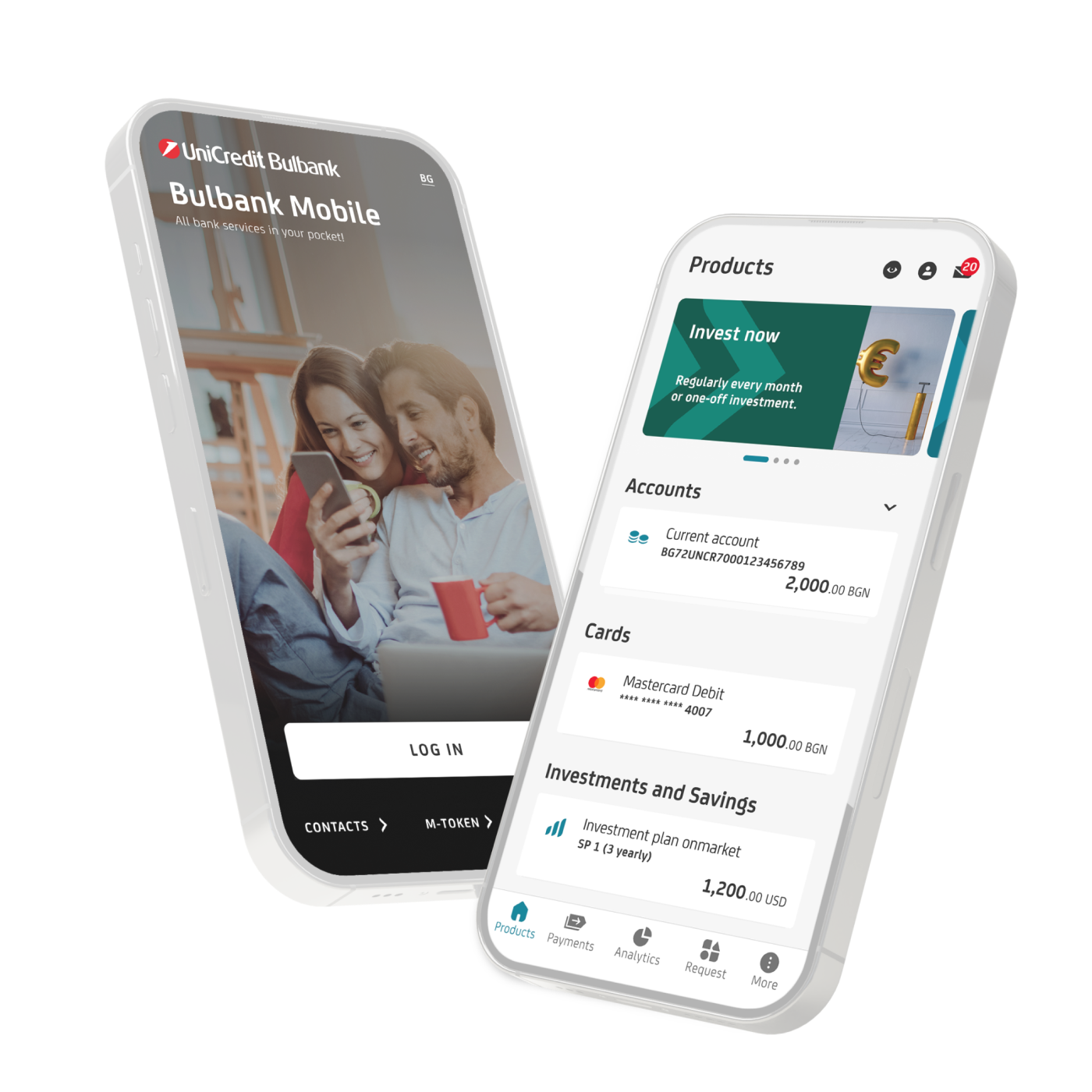

UniCredit Bulbank offers flexible terms so that you can have the home you have always wanted.

Build a cosy and energy efficient home with our help.

Mortgage loan features for

Purchase of an existing prefabricated house

- Maximum amount up to BGN 500,000

- Repayment period - 20 years

- Age at expiry – maximum 70 years - Financing up to 70%

- Own contribution minimum 30% of the value of the preliminary contract

- The building permit must state that the building in question is a permanently attached facility and not a relocatable one;

- Income to be deposited in an account with the bank;

- Subject to financing will be houses built within 5 years of the day of issuance of the use permit.

Construction of a prefabricated house

- Maximum amount up to BGN 500,000

- Repayment period - 25 years

- Age at expiry – maximum 70 years - Financing up to 70%

- Own contribution minimum 40% of the value of the preliminary contract

- The building permit must state that the building in question is a permanently attached facility and not a relocatable one;

- Income to be deposited in an account with the bank.

Further information can be obtained by calling *2274 or visiting your nearest UniCredit Bulbank branch.

Advantage of prefabricated houses

Prefabricated houses are an increasingly popular alternative to traditional construction thanks to the number of advantages, including:

- Faster construction

- Less construction waste

- Easier estimation of construction costs

- Higher energy efficiency

- Lower construction costs

- An opportunity to use a land plot which does not meet the requirements for monolithic construction, and more!

Frequently asked questions

You can apply in any UniCredit Bulbank bank branch.

You will need to submit the following documents: market appraisal of the property/land plot and the investment project for the construction, title deeds, design visa, use/construction permit. You can find out more about the full set of necessary documents at your nearest branch.

The interest rates under a prefabricated house mortgage loan are in line with the approved rates for all mortgage loans.

- For the purchase of an existing prefab house – the loan value cannot exceed 70% of the market value calculated by a licensed appraiser.

- For the construction of a prefab house – the loan value will be based on the respective bills of quantities and the approved investment project.