"My New Home" Mortgage Loan

Mortgage loan calculator

The calculator is intended to help you determine your financing needs, as well as calculate future loan payments, and the results of the calculations are not binding on the Bank. The indicative calculations are valid for the entire term of an annuity contract.

Characteristics

Amount of funding

IconUp to 85% of the property market appraisal, allowing the customer the option of being liable with his/her entire property or bear limited liability up to the amount of collateral provided.

Purpose

Icon-

Mortgage loan for the purchase of property, for construction and/or finishing works

-

Refinancing of similar target loans

Term

Icon-

From 61 days to 30 years

-

Age at the end of the loan term - 75 years max (at the age of over 70 it is necessary the debt ratio of the client is below 60% and to have life insurance).

Collateral

IconThe first-ranking mortgage on the property serving as collateral or on another property.

Life insurance is required

IconYes

Property insurance is required

IconYes

*Reference interest rate for the relevant currency - HTDI for BGN, EURIBOR for EUR.

Example:

Authorized loan amount – 150,000 BGN, Loan term: 30 years, Type and number of installments: 360 annuity installments:

The amount of the monthly repayment installment for a mortgage loan with a promotional floating interest rate of 2.69% is 667. 69 BGN/ 341.38 EUR and APR is 3.57% for the entire term of the loan. Total amount due at the end of the period - 243 780.97 BGN/ 124 643.23 EUR.

A monthly life insurance premium of 52.50 BGN/ 26.84 EUR or 18 900 BGN/ 9 663.42 EUR for the entire term of the loan and property insurance premium of 168.30 BGN/ 86.05 EUR for the first year.

The annual property insurance premium is calculated based on the remaining loan debt/the property market appraisal at the time the loan is granted.

The calculations in the examples include costs for the preparation of the collateral documentation in the amount of 450 BGN/ EUR 230.08, a monthly fee for the loan servicing account in the amount of 4.44 BGN/ 2.27 EUR, costs for property insurance with coverage for the remaining debt on the loan, costs for life insurance for the entire term of the loan.

Possible fluctuations in the foreign currency exchange rate may impact the total amount due by the consumer.

Salary transfer is a necessary requirement for receiving the loan.

The APR on the loan shows the total costs on the loan to be paid by the consumer, present or future ones, as an annual percentage calculated on an annual basis from the total amount of the loan granted.

The additional costs payable under the loan agreement, which are part of the APR after they become known to the Bank, are as follows:

- The notary and state fees for establishing a mortgage in favor of the Bank; The notary and state fees for renewing and deleting the collaterals established in favor of the Bank; The costs for preparing a market appraisal of the proposed collateral

- Type of installments: Equal monthly installments (annuity) and decreasing monthly installments

- Interest calculation method: Actual number of days/360

- Frequency of disbursement: One time or in tranches as per the agreed disbursement schedule

The calculation presented in euro is only for the purpose of double-counting the amounts in lev and euro. In case of repayment of liabilities with funds in a currency other than BGN (other than the currency of the loan), it is necessary to provide the BGN equivalent at the Bank's "buy" rate announced for the day.

The APR on the loan shows the total costs on the loan to be paid by the consumer, present or future ones, as an annual percentage calculated on an annual basis from the total amount of the loan granted.

The additional costs payable under the loan agreement, which are part of the APR after they become known to the Bank, are as follows:

- The notary and state fees for establishing a mortgage in favor of the Bank;

- The notary and state fees for renewing and deleting the collaterals established in favor of the Bank;

- The costs for a market appraisal of the proposed collateral.

The above additional costs are not included in the total loan costs indicated in the example and are part of the APR, when they become known to the Bank.

Frequently Asked Questions

The mortgage loan is a type of cash loan provided by a bank most often for the purpose of purchasing a home - the real estate is the collateral for the payment.

A mortgage loan is a general term referring to all loans secured by a real estate mortgage. A home loan is a loan for the purchase of a real estate - a house or apartment; most often the purchased real estate is secured by a mortgage of the purchased property.

In the case of a loan agreement with a floating interest rate, the creditor applies an interest rate based on their chosen methodology. The methodology contains a clearly outlined calculation procedure (formula), which specifies the type, the quantitative expressions and the relative weight of each component.

The bank calculates creditworthiness or the so-called debt/income ratio. This ratio should not exceed the limits set by the bank. The minimum income required after deduction of taxes, social security contributions and the so-called cost of living is BGN 300.

In order to be approved for a mortgage loan, a customer must meet several standard requirement:

- To be 18 or older;

- To have a permanent employment contract and not be in a probationary period;

- To have a clean credit history;

- To have regularly paid social security and health insurance contributions;

- To be able to prove an income, of which 50-65% is to be sufficient to cover all monthly obligations, including the new mortgage loan installment.

Mortgage loans are repaid through decreasing or equal monthly installments, most often automatically withdrawn from the customer’s account. In case of equal (annuity) monthly installments, the total amount of the monthly installment remains the same, while the interest decreases and the principal grows at the agreed rates. When the loan is repaid through a decreasing repayment plan, the first monthly installment is the highest one and each consecutive monthly installment gradually decreases. The reason is that the interest installments decrease, while the monthly principal installment remains the same.

For any request to renegotiate the terms of the loan, a request must be submitted on the bank's form. This can be done by contacting your Relationship Manager or visiting a bank branch. If the renegotiation request is related to the need to re-evaluate the loan and/or collateral, the loan officer may ask you to provide the necessary documents. You can check the applicable fees depending on the type of renegotiation in the Bank's fee schedule.

For properties in the cities Sofia, Plovdiv, Varna, Burgas, Blagoevgrad, Stara Zagora, Pleven, Ruse and Veliko Tarnovo, you can get financing up to 85% of the property's market value, and for all other cities in Bulgaria the amount is up to 80%.

What's new

Documents

The application documents depend on the customer profile. Follow the guidance of your bank consultant when preparing them.

Did you find your dream home?! Now it's time to check all required documents all required documents for consideration of the loan application.

UNICREDIT BULBANK АD, entered in the Commercial Register with the Registry Agency under UIC 831919536, registered seat and address of management: 7 Sveta Nedelya Sq., Vazrazhdane District, city of Sofia, website: www.unicreditbulbank.bg, licensed to carry out banking activities under the supervision of the Bulgarian National Bank by virtue of Order No. РД 22-2249/16.11.2009 of the Governor of the Bulgarian National Bank.

Application

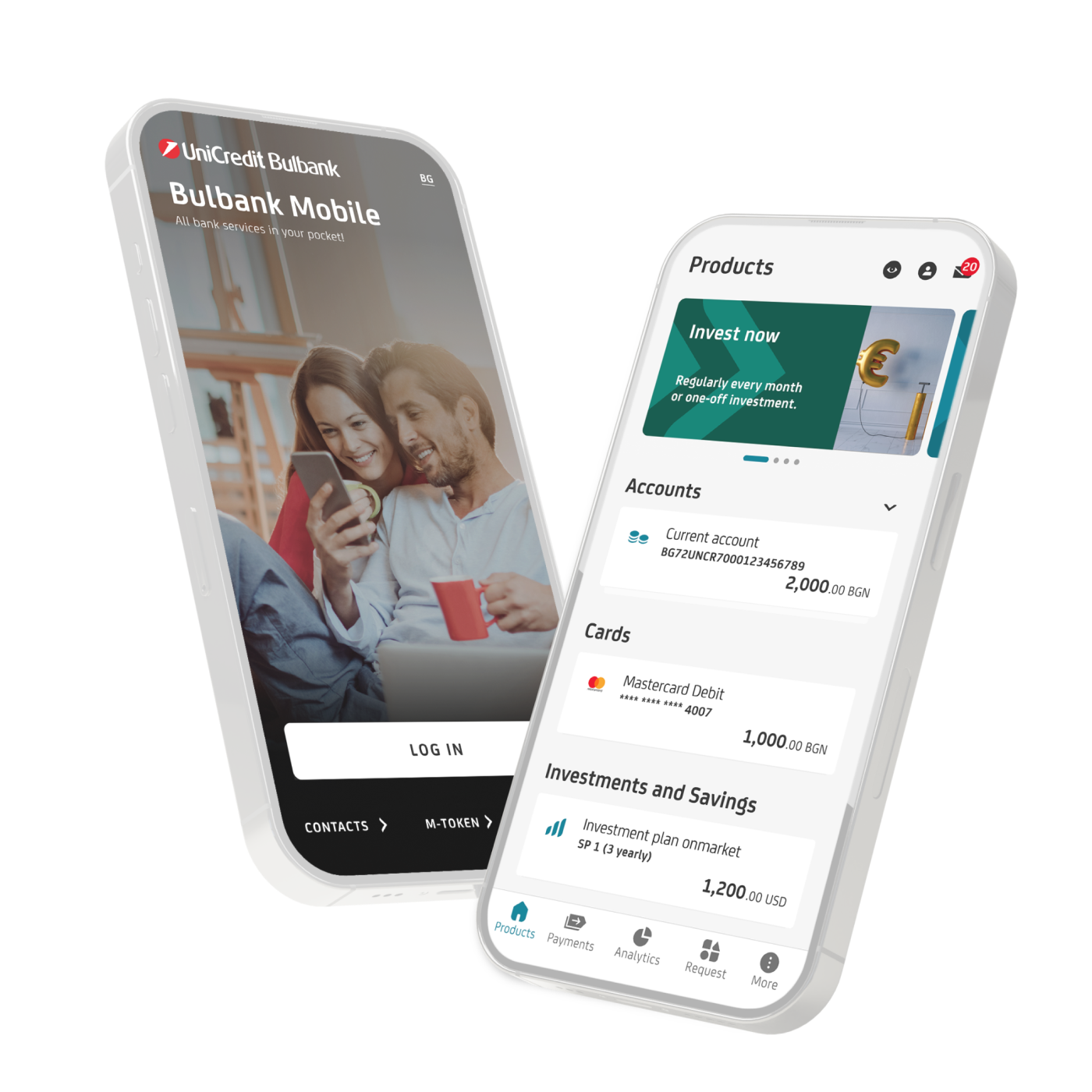

Apply remotely

and go easily and conveniently through the steps to your desired home.

Schedule an on-line consultation with an expert and receive a personal offer.

Benefit from the legal information and exchange documents electronically.

Receive approval and sign the agreement electronically.

Easy and completely remote

Fill out the short form for your mortgage loan in just a few clicks.

Remote Consultation

02/ 933 72 22 at the price of a local call

Bank Branch

Visit the nearest branch of UniCredit Bulbank.