Consumer Loan

Characteristics

Terms

IconFrom 3 up to 120 months

Currency

IconBGN

Minimum amount

Icon500 BGN

Maximum amount

Icon100 000 BGN

Type of interest rate

IconAt the option of the borrower:

- Fixed for the entire credit period

- Variable - set aside of market interest rate index (HTDI) plus a margin.

Interest conditions

IconPricing parameters are consistent with:

- Amount of the loan

- Transfer of salary at UniCredit Bulbank

Possibility for concluding an insurance

Iconwith an insurance company partner of UniCredit Consumer Financing

Fees and commissions

IconNo fee

The consumer loan is provided by UNICREDIT CONSUMER FINANCING EAD. The monthly installment amount depends on the date of loan utilization and the selected maturity date.

*The interest rate of 4.44% is for floating interest rate valid under the following terms and conditions: For loans over BGN 45,000, a salary transfer, an insurance and a digital signing of documents and gross insurance income equal to or above the maximum insurance threshold. Offer valid until 30.06.2025.

Example: A consumer loan in the amount of BGN 50 000 for 84 months and no review fee. A monthly installment of BGN 538.60 with a floating AIR of 4.44%, an APR of 5.68%, a salary transfer and a digital signature of the loan agreement.

The total amount due at the end of the loan period is BGN 64 631.54, including insurance "Credit Protection Pakatage A" for the total amount of BGN 2 635.20 for the entire loan term. A monthly insurance premium of BGN 21.96, which is included in the monthly installment. The loan insurance is not mandatory and is additionally provided at the customer's choice. In the event that no insurance is added to the consumer loan, other loan terms and conditions apply. The interest rate is determined based on the selected repayment period, the signature method and the availability of loan insurance.

How to apply?

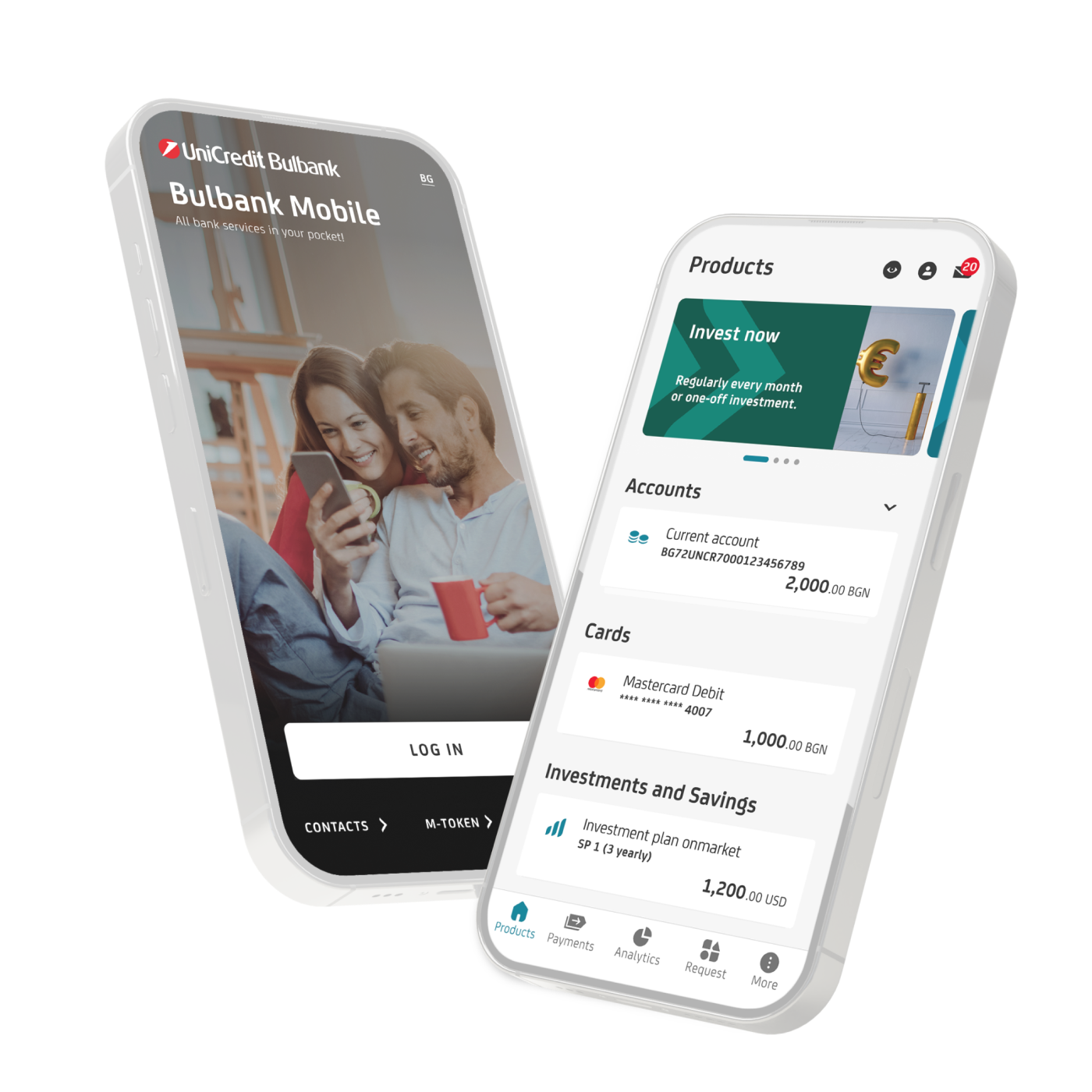

- If you do not have an account with UniCredit Bulbank, download Bulbank Mobile application and become our customer entirely digitally.

- Activate the mobile application and go to the Request menu.

- Follow the steps in the app and sign the loan agreement through the app.

You can also apply for a consumer loan at *2274 or at a branch of UniCredit Bulbank.

Documents and insurances

Documents Required

- ID card only*

*UniCredit Consumer Financing reserves the right to require additional documents

Additional information

Frequently asked questions

A consumer loan is a loan type, deferred payment and any other similar type of payment facility over an extended period of time where the consumer pays for the value of the services by making periodic payments over the period of their provision.

The customer must be aged between 18 and 75 at the end of the consumer loan agreement, have a provable income in Bulgaria and a valid identity document.

By this process the terms and conditions of a current loan agreement are reviewed with a view to changing and updating them.

No guarantor of the loan is required at the time of application.

This is a national information register located and maintained by the Bulgarian National Bank, in which all loans utilized by companies and individuals in Bulgaria are recorded. Every bank, non-bank and financial institution in the country is required to provide the CCR with monthly information on all loans granted, overdue or repaid by its customers/payers. Everything related to the loans is recorded in the CCR - the amount of the active obligation, the payment status of the installments - if they are regularly repaid or not, when the obligation was repaid in full and whether there is a delay in payment.

The annual percentage rate charged on the loan shows the total costs on the loan to be paid by the consumer, present or future ones, as an annual percentage on the total amount of the loan granted.

If your salary is transfered to UniCredit Bulbank, you will benefit from a lower interest rate on the loan. It is not compulsory to have your salary transferred to the bank but if this is done, you will benefit from the most advantageous consumer loan conditions offered by UniCredit Bulbank.

There is no early repayment fee for consumer loans with a variable annual interest rate. For loans with a fixed annual interest rate, the customer pays an early repayment fee, which is 0.5% of the remaining debt on the loan, if less than one year remains until the repayment of the loan and 1% of the remaining debt on the loan, if more than one year remains until the repayment of the loan.

Learn more in our Help Center.