Debit card Mastercard World Elite

Characteristics

The Mastercard World Elite debit card gives you convenience, flexibility and security wherever you use it. Use the card actively when purchasing goods and services in retail outlets or online, secure your travel, shop with pleasure.

With Mastercard World Elite, you can also enjoy special offers ensuring convenience and comfort when traveling by plane, as well as other boutique offers.

Currency

IconBGN, EUR, USD

Time limit for issuing

Icon5 working days for standard

Card validity

Icon6 years

Additional card

IconYes, it is charged at the Bank's rate

Lock/ Unlock a card

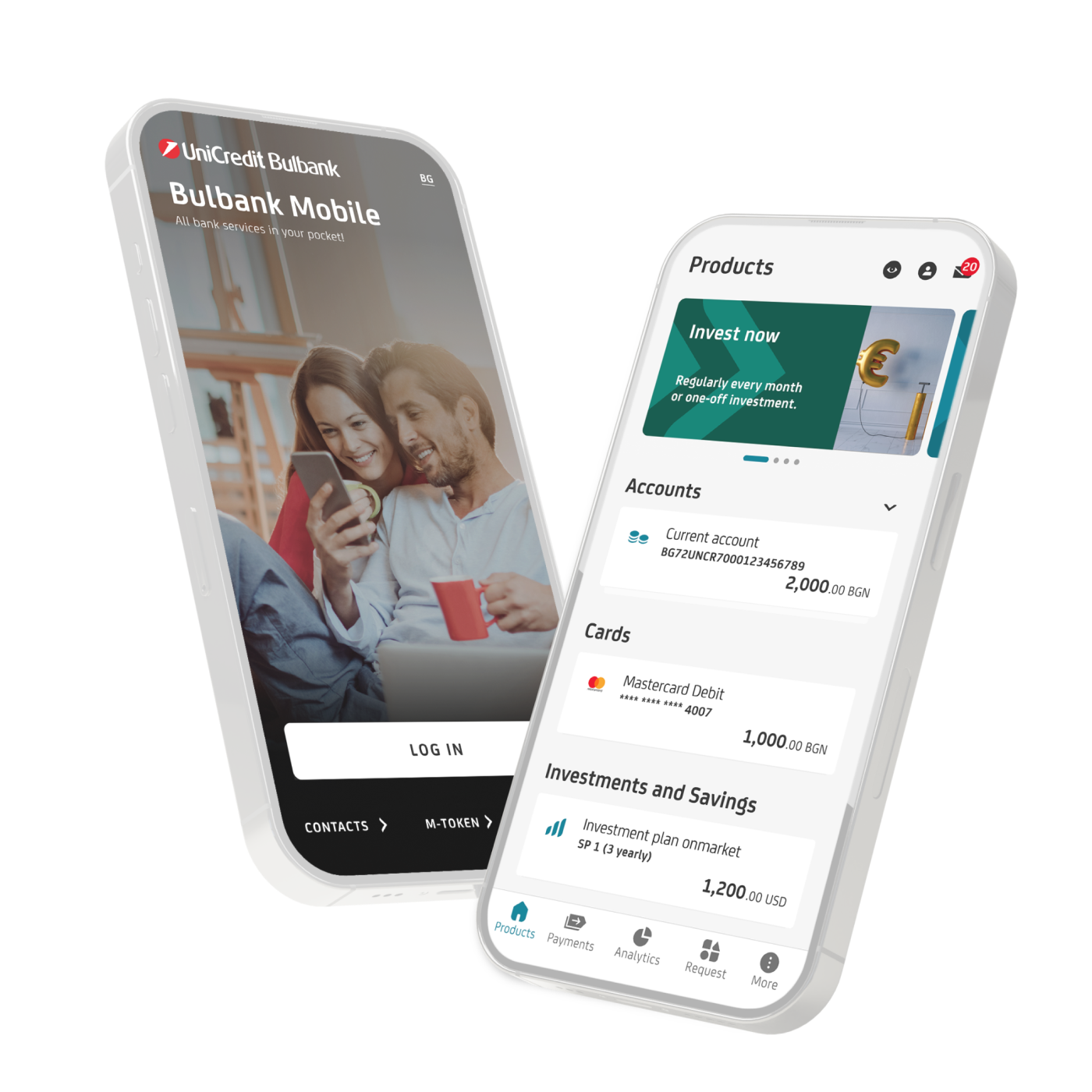

IconManage your card status through Bulbank Mobile for free

Secure payments to online merchants

Iconwith dynamic password

24/7 Call center

IconIn case of an accident or if you need to check the card balance

No PIN entry for amounts up to BGN 100

Iconfor contactless payments in the country

Card digitalization

IconAn option to add to Apple Wallet and Digital Wallet for Android users

International debit card

IconNoo payment limits

Card activation

The card activation process is now much faster and easier. Once you have your bank card, you can activate it yourself by changing your original PIN at UniCredit Bulbank’s ATM or all other ATMs with the logo of BORICA AD*.

*Activation of a card and change of PIN code is possible only at ATMs in Bulgaria!

View the full list of card parameters under the Tariff, as well as the General Terms and Conditions for opening, servicing and closing bank accounts for individuals and for providing payment services and tools.

Travel and Accident Insurance

Travel and accident insurance provides you comfort during your travels abroad.

- The insurance is provided as a gift to the cardholders with debit cards MasterCard World Elite

- Over 20 insurance covers on the territory of the whole world

- Medical assistance24 hours a day, 7 days a week

Characteristics

Travel and accident insurance

IconProvides you comfort during your travels abroad. The product is presented as a gift from UniCredit Bulbank and provides over 20 insurance covers on the territory of the whole world:

- Emergency medical expenses due to accident or illness

- Emergency dental treatment

- Third party liability for material and non material damages

- Luggage delay/Loss of luggage

- Medical transportation

- Many more

Validity

IconThe cover for abroad is valid for unlimited number of travels 365 days (with maximum single travel of 90 days).

Activated

IconThe insurance cover is activated with purchase of tourist package or a part of it / airplane ticket, bus ticket or other trasport, hotel reservation, rent-a-car/ or other service connected with the travel, purchased with the credit card on the territory of Bulgaria or by using the card on ATM or POS abroad during the travel.

Insurance term

IconThe insurance is concluded and is renewed by the bank. In case your bank card has been issued/ renewed/ active since 01.09.2022. the Insurer is "AWP P&C S.A., branch Bulgaria" (Allianz Partners). The validity of the policy is until 31.12.2025.

Documents

Our special proposal for private clients is the black debit card of the highest class - Mastercard World Elite, which has high withdrawal limits and no payment limits.

The entire range of debit and credit cards of UniCredit Bulbank is also at your disposal, as well as digitized debit and credit cards.

When a payment is made in a currency other than the currency of the card, the amount of the payment shall be converted into a settlement amount according to the foreign exchange rate of the International card organizations applicable on the settlement date. The account/credit card is debited at the Bank's relevant sell exchange rate applicable on the day of booking the particular transaction, which serves as a reference exchange rate. The currency of the settlement amount is EUR.

UniCredit Bulbank AD does not apply any additional fees in case of currency conversion of transactions carried out with bank cards.

Debit and Credit Cards

Cards Services